Leverage Point Portfolio Update

February 2022 YTD Return: -27.5% (-18.5% vs. the S&P)

Note from the editor: This newsletter is published twice a month, I do an end-of-month summary of my portfolio and a mid-month thought piece on investing.

If you want to ask questions or get real-time investment updates your best option is to follow me on Twitter here.

Year To Date Leverage Point Portfolio vs. Benchmarks:

NASDAQ -13%

S&P -9%

Leverage Point Portfolio -27.5%

I know the drawdown has been difficult. Keep in mind it’s only been four months, but boy, it sure does feel like an eternity.

It’s at a time like this when I remind myself that, at least for me, this is about multi-year performance.

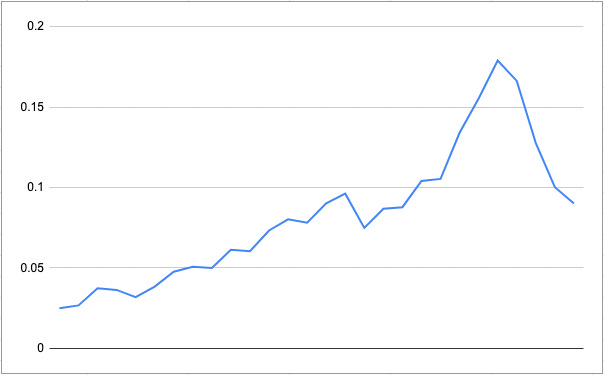

I graphed my monthly returns recently so I could get a big picture look at my performance. My portfolio peaked in October of 2021 and it has sold off, in every stock I own, ever since. No amount of portfolio management mattered. Here is the lifetime chart of what my portfolio’s performance looks like to date.

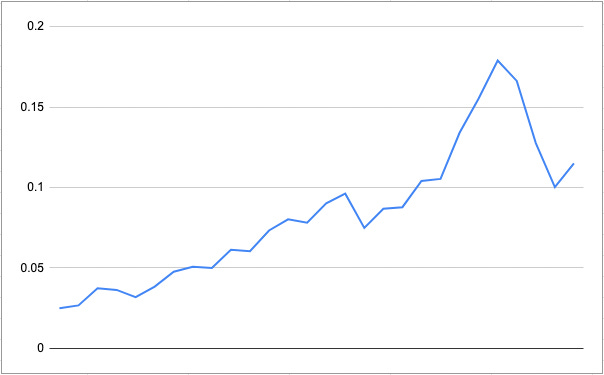

It looked a lot better only a few weeks ago. There was a nice rally on February 9, and the chart started to tick back up. This was encouraging and I think this chart (below) shows just how fast things can bounce back.

The average bear market is eight months long. If you believe this, we have four more months of volatility and then recovery starts in June. It will be early summer. Inflation numbers should be coming down, people will be outside shopping, and the pandemic will be behind us. It’s hard for most to see the light at the end of the tunnel now. But just believe me, there is one. There always is one.

But for now, it’s going to be tough.

Earnings Were Good, Stock Prices Were Not

My new rule is to sell any position that rises to over 20% of my portfolio. DataDog (DDOG) popped on earnings and ran up to over 30% of my portfolio. I trimmed 10%. I am so glad I did because all my stocks sold off again with the invasion of Ukraine. Having some cash to put to work was smart.

Monday.com, I am a Seller (MNDY)

Most of the earnings reports for the stocks I follow were good. The one exception was Monday (MNDY). They only guided for 50% growth this year, which is a huge slow down from 90% revenue growth last year. While this still meets my 50% or more growth policy for my portfolio, it’s off of a small base. The company earned $308.2M for all of 2021. A 50% increase off of that is only $154.1M. Growth slowing this much, at this stage, means the market for their product is very competitive. The Superbowl commercial is a clear sign they have tapped out the low-hanging fruit. I sold half and will probably sell off the rest this quarter.

I Still Like Affirm (AFRM)

The market hated the ER from Affirm (AFRM) and it sold off -25%. This is BS. I will hold my position. Why? Because they debunked all the rumors that they had high levels of default. This is huge in my opinion and proves the model works. But, Wall Street now says AFRM needs to rip off their customers and profit more from them? They carry too many no-interest loans? This is crazy. They are in hyper-growth mode and are trying to gain market share as fast as possible. As long as growth metrics stay strong I am in.

Grew active consumers by 150% annually from 4.5M to 11.2M

Grew active merchants by 2,030% annually from 7.9K to 168K

Grew GMV by 115% annually from $2.1B to $4.5B

The growth story is not over and I am betting active consumers will keep growing significantly. That’s the most important number. If they can get to 20M active consumers this year, they will be a real player. American Express only has 50M members in the US for reference. Once they get to scale, the profits will follow.

Let’s Get Real (REAL)

Yep, I am still in this. The ER was good. They beat all the estimates and provided good guidance. Wall Street even liked it. The stock has been beaten down to smithereens because this category is out of favor and most investors are men who don’t understand a business like this. Why do I like this? Luxury retail has great markups. Reselling is a hot trend that is only going to increase in popularity. The pandemic is over and shopping is back. They have no meaningful competition. Total Revenue for 2021 was $468 million, an increase of 56% compared to full-year 2020. And they are projecting around 40% revenue growth for 2022 of $650M. It’s not cloud. But it’s a bigger, better business than Monday.com.

Earnings for all my other stocks start on March 1.

Buy, Buy, Buy

With the cash I had on hand I started positions in two cloud stocks that have stellar track records and appear to not be beneficiaries of the temporary COVID pull forward, like DocuSign, Olo, Zoom, Peloton, or a lot of other fallen angels. The real trick right now is determining who experienced unsustainable pull-forward and who did not.

Z Scaler (ZS): The Ukraine invasion has highlighted the value of cyber security. This took a dive on weak guidance, but it’s a sold business.

Bill.com (BILL): SMBs will continue to digitize their back offices and I see no signs of this slowing down. It’s a great service and keeps getting better.

Leverage Point Portfolio YTD by Month:

Jan: -21.5%

Jan: -27.5%

Core Portfolio Holdings:

DDOG 22%

REAL 19%

SNOW 14%

SOFI 11%

AFRM 9%

SEMR 6.5%

MNDY 4%

BILL 2.5

ZS 1%

CASH 9%

Summary of Investment Thesis by Company

Below is a concise summary of each company and why they are in my portfolio, in my own words. No corporate jibber-jabber, or regurgitating of marketing.

What they do: Back office accounting system for SMBs to help them pay bills, manage payments, send out customer invoices.

Why I own it: The company has made some smart acquisitions and is growing rapidly as demand for a fully cloud-based solution increases.

What’s unique about them: They simplify the process of approving invoices prior to payment and enable digital ACH bank to bank transfers.

When would I sell: If customer acquisition slows for any reason it would be problematic for the stock. I want to see it stay at 60% to 70% or more YoY.

Notable News: The Divvy acquisition has been significant for them putting Bill.com in a leading position increasing their offering.

What they do: Cloud-based enterprise cyber security that offers a more secure version of what is known as a virtual private network (VPN).

Why I own it: Cyber security is top of mind as the volume and ferocity of cyber security breaches continue to accelerate.

What’s unique about them: ZPA is an easier to deploy, more cost-effective, and more secure alternative to VPNs.

When would I sell: If revenue growth was to slow down to under 50% annual I would definitely sell. A QoQ growth slowdown would be something to watch for.

Notable News: Not too many new announcements, Zscaler Positioned as a Leader in the 2022 Gartner® Magic Quadrant™.

What they do: Consumer fintech company that offers a full suite of digital-first banking services including student loan refinancing and stock investing.

Why I own it: Profitable on an EBITDA basis and they continue to scale member growth at over 90% YoY for the past four quarters.

What’s unique about them: The membership model is compelling as it should reduce churn and increase LTV.

When would I sell: If customer acquisition slows for any reason it would be problematic for the stock. I want to see it stay at 60% to 70% or more YoY.

Notable News: All the haters said it wouldn’t happen, but they received bank charter approval which dramatically increase profitability for them.

What they do: Cloud-based office productivity suite that includes project management software optimized for remote work.

Why I own it: Sustained revenue growth at over 80% for the past three quarters and a steady increase in customers spending over $50K.

What’s unique about them: Others have a similar vision but Monday executes extremely well and is able to roll out new product functionality fast.

When would I sell: If growth in customers spending over $50K was too slow significantly I would be concerned.

Notable News: They continue to launch new products, and are building a full suite of tools to compete with Google Docs.

What they do: Cross-cloud data warehouse services that make it easy for companies to manage large-scale datasets with less overhead.

Why I own it: They are on track to meet their goal to grow to $10 billion in annual product revenue by fiscal 2029.

What’s unique about them: Snowflake’s success as a cross-cloud tool has a network effect that drives more developers and partners to the platform.

When would I sell: The company remains richly valued and while the growth is tremendous, the stock may languish.

Notable News: Not a lot of news except the release of CEO Frank Slootman’s book which I have downloaded, but haven’t started yet.

What they do: A full suite of tools to manage and grow organic traffic to a website across a variety of search engines.

Why I own it: Steady growth is just under 50% and I think there is potential to accelerate as more marketers adopt search in 2022.

What’s unique about them: No competitor offers the full suite of tools in one package and a competitive price point like SEMRush.

When would I sell: It’s possible that growth slows as adding new customers in 2022 gets harder as they increase market share.

Notable News: They launched an App Center that allows other third-party integration to market their tools to SEMRush customers.

What they do: Affirm is the market leader in BNPL (Buy Now Pay Later), an alternative to credit cards with better rates and instant approval at checkout.

Why I own it: Massive growth from recently closed partnerships with all major U.S. e-commerce players including Shopify, Amazon, Walmart, and Target.

What’s unique about them: Technology is superior to competitors and the pipeline of product updates is strong most notably Affirm Card offers.

When would I sell: I am closely following active customers and the average number of purchases. I want to see those two grow substantially.

Notable News: Lots of product development announcements, and this one that flew under the radar. They now offer cashback rewards.

What they do: Observability platform for engineers to monitor systems, databases, and other technologies to get data to improve performance.

Why I own it: Core infrastructure data products like this have high switching costs and once implemented rarely are removed.

What’s unique about them: With more than 350+ integration options competitors don’t seem to be able to offer the same level of extensibility.

When would I sell: The company is now approaching a $50B market cap and that could just make hyper-growth harder to sustain.

Notable News: There is a great post here on Software Stack Investing detailing all the new updates and features.

What they do: Largest market for reseller market for authenticated luxury goods that operates both online and physical locations.

Why I own it: Revenue growth has been at 50% and average order value continues to increase, in December it hit $518 per order.

What’s unique about them: While there are many reseller markets, The RealReal is the largest that exclusive to authenticated luxury goods.

When would I sell: If growth were to drop below 30% or AOV declines significantly I would be concerned.

Notable News: They just hit 25M members and are by far the largest in the reselling space. No competitors come close.

About Me

I have worked in internet media and technology on the business side my entire career. I live in the SF Bay Area and focus on investing in what I know, high-tech growth companies. I try my best to stay in my circle of competence.

Investing Style

I like to buy small positions, this gets me focused to learn about a company. Then I sell, or I add to it over time in small increments depending on a variety of factors. Some positions I hold for years, others for only a few months. My goal is CAGR. Not 10-baggers and I try hard not to fall in love with a stock. My aim is to maximize my returns and I have no allegiance to any particular method or style of approach.

My portfolio is concentrated and I aim to hold a maximum of 10 stocks at the same time. The fewer the better. I consolidate around my highest conviction picks while looking for new opportunities to cycle into.

I sell on a dime. Which is a massive advantage of retail investing. If there is something I don’t like, I don’t take any chances and I just sell. This is why I take a small position at first and test drive my ideas. If for whatever reason I change my mind, I just take the loss (or gain) and move on. Sometimes, I just decide I want more cash for peace of mind and sell. I can always get back in at a later date if I want.

I have an obvious bias to SF Bay Area high-tech companies and for good reason, it’s an ecosystem that I know well and like. I think it gives me a slight edge, beyond the numbers when investing.

Things I look for in a business to invest are:

Sustainable competitive advantage: This can be superior technology, but it can also be brand, business strategy, or even company culture.

Massive growth runway: The companies I like to invest in have a large total addressable market (TAM) and no obvious ceiling or limit.

Great management with a clear vision: While not exclusively founders, I like management with a track record who can clearly articulate their vision.

Are in hyper-growth mode: Revenue should be growing at least 50% YoY and can be sustained. If it can accelerate, that’s even better.

I have unique insights into it: I look for businesses that I have a personal connection with. Maybe a product I use? Or management I have met and liked.

A business vertical I know well: I focus on businesses and eco-systems I understand intimately and it’s why I have avoided areas like biotech.

And what I avoid:

No open-source companies: I think the open-source model is flawed when it comes to building a strong scalable business.

No Chinese companies: The SEC’s own guidelines say they are limited in their ability to enforce regulations in China.

No penny stocks: I avoid companies that are under $1B in market cap. Those stocks are too easy to manipulate given the low volume and float.

No stocks on non-U.S. exchanges: Maybe I just haven’t found the right pick, but in general, I avoid foreign listings as they are harder to manage.

No crypto or NFTs: Coins are not fractional shares in a business and have no underlying value other than what someone will pay you for them.

Overall Returns Since February 2020

Portfolio returns since I started closely tracking it in February 2020 is 147%.

DISCLAIMER:

This post is simply an end-of-month summary. Positions can change immediately. With or without notice. Do not make decisions based solely on my writings. Do your own due diligence and make your own investment decisions. Rember that predictions are hard to make, particularly when they are about the future.