Note from the editor: Thank you to everyone who has subscribed to this substack. There haven’t been too many new subscribers to this newsletter in the past month, shocking right?

If you want more timely portfolio updates you can follow me on Twitter.

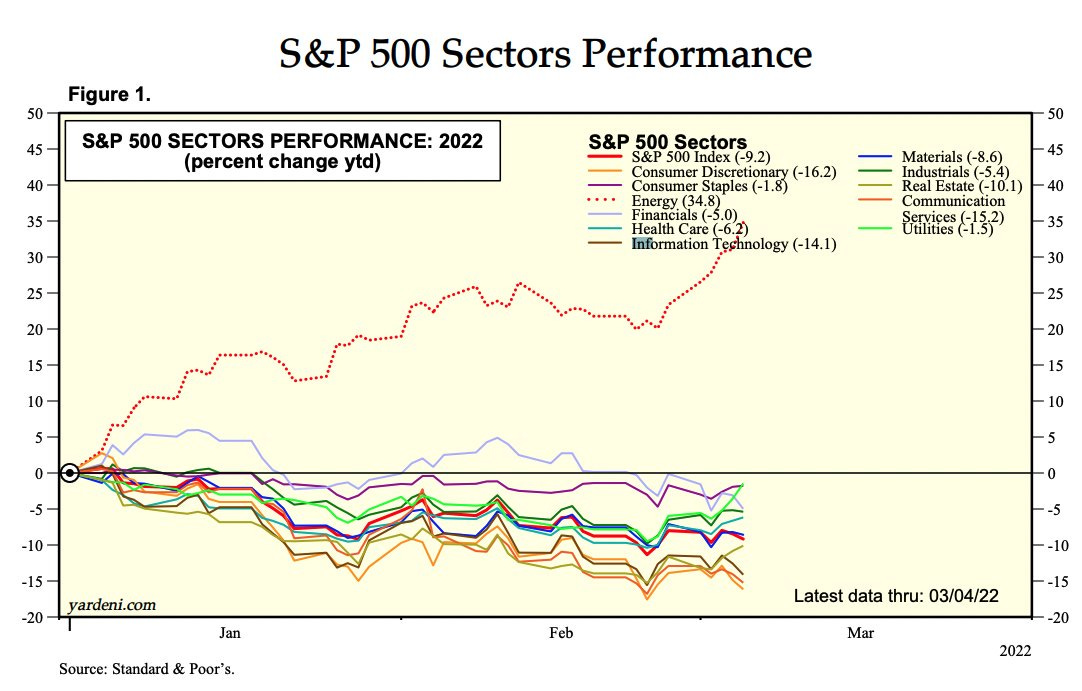

Nowhere to run. Nowhere to hide.

As this chart shows, it’s been tough out there for stock investors. The only segment that has performed well this year is energy. And remember, this is the S&P. If you’re invested in the crazy wild, wild, west of small-cap growth stocks, it’s been a painful ride down.

Just know that this chart shows it’s not you. No amount of stock picking or portfolio management could have avoided this other than going all cash at the peak. If you had the foresight to do that, please post a reply with a link to your substack below.

What’s one to do?

On Friday I sold off a bunch of stuff to raise cash. Yes, this is what is known as capitulation. The war has changed everything. I don’t think it will be over soon and I think it will wreak havoc on access to minerals. (update: Elon just said this about mineral prices today)This will be bad for semiconductor production, which will impact car manufacturing and keep inflation high. It will disrupt energy flows to Europe increasing prices and potentially pushing Europe into recession. Wheat and other food product supplies will also be disrupted. The U.S. will not be directly impacted, but Europe is a big market for American companies. All of this is not bullish for stocks.

No one knows what will happen next

Will the market correct more? Is all the bad news baked in? Will the Fed slow the speed of rate increases? What if Russia negotiates a ceasefire? No one knows the answers to these questions.

My approach right now is to hedge my bets. I am still holding what I think are the growth stocks that have the most potential to grow. I sold what I thought will never come back. I also bought an oil ETF. I think prices will keep going up. Spring is coming and with the reopening, people are going to start to drive — “prices be damned.” I am now 50% growth stocks and 50% cash and oil.

With this setup, if growth stocks rally, hooray. And I have some protection to the downside. It’s quite possible the correction continues.

Reversion to the mean

I went back to the Clouded Judgement newsletter archive and pulled this chart from the first edition. This shows that prior to 2020, multiple on cloud stocks traded in a range from 5X to never more than 20X of EV / NTM (Enterprise Value / Next Twelve Months, it’s explained in Clouded Judgement newsletter).

Here is this same chart from this month.

On average, valuations are back to where they were pre-pandemic. But the challenge is the forward outlook is weak. There is no obvious catalyst to accelerate growth and while earnings have been good for Saas and cloud stocks, all of them are them are providing guidance that is much lower than we have seen in the past two years.

Don’t be held back by dogma

All of this has me thinking about dogma, and not adhering too closely to one strategy. I have a detailed and rigid methodology, but right now, I am keeping an open mind as to how I want to invest going forward. The landscape today is different. There is a lot of uncertainty and I think what worked in the past may not work going forward. This is what drove me to go long oil and raise cash.

I greatly appreciate the reassessment of your approach. There are (likely) many high growth investors who say they are sticking with a saas only 10 max stock approach. Though many times, things aren’t truly different, the European dynamics on top of COVID are different. It’s probably wonderful to be wealthy enough to wait for the market to shift back up, whenever that is. But if one doesn’t account for the present, are they thoughtful, or anchoring? All the research in the world on how dynamic a growth company is cannot overcome the reality that is.

I’ll be thinking more on what I’m doing; your post encourages me to be more neutral and less wedded to what might happen, and look more clearly at what is happening.